A whole lot is different worldwide of health-related nutritional supplement strategies. It may be challenging to take care of the alterations, but don’t get worried – we’re here to help! Let’s look at a thorough guide on registering for Medicare Supplement Plans in Texas by wandering through each move of the method to create an educated selection about which strategy is right for you. Don’t wait around any longer – read on to get going!

The Stage-By-Stage Method:

Step one is always to understand your needs. What are you looking for in Greatest Medicare Supplement Plans Texas? Do you need protection for prescription medications or simply common wellbeing goods? Once you know what exactly you need, you could start shopping for the best strategy.

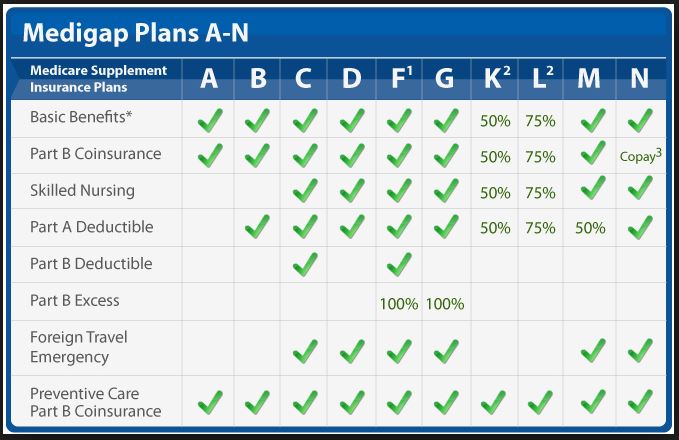

There are some different health care supplement plans: HMOs, PPOs, and POS. HMOs normally have decrease month-to-month costs but greater out-of-pocket costs. PPOs normally have higher monthly costs but permit you to see any medical professional that accepts the master plan. POS plans are a mix of both – they often have lower month to month premiums but better out-of-pocket fees.

When you’ve chosen the particular Texas Medicare dietary supplement strategy you would like, it’s a chance to make a price comparison. There are many various ways to get this done: you should use a web-based resource like health insurance or make contact with each company specifically.

As soon as you’ve identified a few medical dietary supplement plans that fit your needs and finances, it’s time and energy to do a comparison aspect-by-area. Check out the coverage degrees, deductibles, copayments, and out-of-budget maximums. Also, see the fine print to understand what exactly is and isn’t included in each prepare.

Now that you’ve explored, it’s time to join the Texas Medigap program! The easiest method to try this is by your employer’s advantages portal. You may still enroll in a plan from the federal government industry if you’re not used.

After you’ve signed up for a plan, stay informed about your payments and coverage requires. Review your plan periodically to guarantee it meets your requirements, and don’t think twice to make contact with customer service if you have any questions.